Curve is a decentralized exchange (DEX) specializing in stablecoins. Utilizes an automated market maker (AMM) mechanism to facilitate efficient and low-slippage trades. The protocol's architecture prioritizes capital efficiency, allowing for deep liquidity pools dedicated to specific stablecoin combinations. Curve offers a variety of markets, catering to diverse copyright needs. Users can deposit funds by contributing to these pools and earning rewards proportional to their share.

- Its core strength on stablecoins makes it a popular choice for traders seeking to complete instant transactions between these assets.

- The minimal cost structure further incentivize its use in scenarios requiring frequent and insignificant trades.

Furthermore, Curve integrates with various DeFi applications, enabling users to access stablecoins for a wider range of decentralized protocols.

Decentralized Exchange Reimagined

Curve Finance is a revolutionary decentralized exchange platform built for the efficient trading of stablecoins and other highly liquid assets. Unlike traditional AMMs that rely on liquidity pools with arbitrary token ratios, Curve implements a unique mechanism focused on providing tight spreads and minimizing impermanent loss for liquidity providers. This innovative design makes Curve Finance the preferred choice for traders seeking reliable and cost-effective trading interactions.

- Additionally, Curve's governance token, CRV, empowers holders to participate in the platform's evolution by voting on proposals and earning rewards for their contributions. This decentralized model ensures that Curve Finance remains a user-centric project.

- In essence, Curve Finance is more than just a DEX; it's a evolving ecosystem dedicated to providing the best experience for all copyright users. With its focus on efficiency, security, and community, Curve is poised to become a cornerstone of the decentralized finance landscape.

Yield Farming on Steroids: Maximizing Returns with Curve Pools

For the serious DeFi enthusiast, Curve pools offer a unique opportunity to maximize your returns. While traditional yield farming can be volatile, Curve's stablecoin focus provides a more stable environment for generating passive income. By leveraging the power of Automated Market Makers (AMMs), you can earn rewards by providing capital to these pools and facilitating trades.

Curve's revolutionary design allows for substantial yields on stablecoin pairs, often surpassing those offered by other platforms. Harnessing the intricacies of Curve pools can reveal a whole new level of return on investment.

Unveiling Curve's Ecosystem: Lending and Borrowing in a New Dimension

Curve Finance is revolutionizing the realm of decentralized finance (DeFi) with its innovative approach to lending and borrowing. By leveraging the power of cryptocurrencies, Curve enables users to utilize liquidity in a streamlined manner. Its unique design focuses on integrating various protocols, creating a vibrant community for DeFi enthusiasts.

Users can now lend their assets Curve Finance and earn competitive yields rates, while lenders can obtain the credit they need at competitive terms.

Curve's accessible interface makes it easy for any skill levels to engage in the DeFi ecosystem. Its strong security measures ensure that assets are protected from unauthorized activity.

Unlocking Liquidity: How Curve Finance Strengthens copyright Traders

Curve Finance has emerged as a revolutionary force in the decentralized finance (DeFi) ecosystem, revolutionizing how copyright traders participate with liquidity pools. By specializing in copyright trading pairs, Curve reduces impermanent loss, a prevalent concern for traders leveraging traditional AMMs. This enhanced liquidity management empowers traders to facilitate trades with reduced slippage and greater efficiency, ultimately fostering a more liquid trading environment. Curve's sophisticated algorithms and intuitive interface make it an appealing option for both seasoned traders and novice to the DeFi space.

The Future of DeFi?

Curve Finance has emerged as a dominant force in the DeFi ecosystem, revolutionizing stablecoin trading and attracting significant liquidity. Its innovative mechanism leverages automated market makers (AMMs) to enable highly efficient swaps between stablecoins with minimal slippage. As Curve's influence continues to expand, it raises intriguing questions about the future of DeFi. Will Curve's success become the industry standard? Can its specialization on stablecoins pave the way for increased financial integration? The answers remain pending, but one thing is evident: Curve Finance's impact on DeFi is undeniable and its future trajectory will be closely followed.

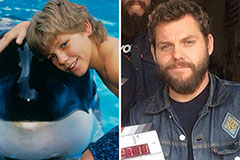

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Kane Then & Now!

Kane Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now!